Professional Liability Insurance

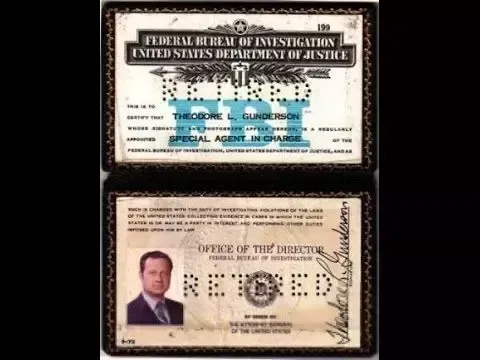

FEDS vs. WRIGHT

If you have been in federal law enforcement for more than a day, then you have probably heard of professional liability insurance. Most special agents are familiar with either one of two companies called "FEDS"(FEDS Protection) or "Wright". These are probably the most commonly known liability insurance companies when it comes to federal law enforcement. In this current day & age I don't think we even need to have a discussion about why you should have liability insurance, consequently, we will skip the discussion to focus on which fits your requirements. In general, it is highly recommended for *every* law enforcement officer to purchase liability insurance.

To start off with let me say that currently I use FEDS(Federal Employee Defense Services). I originally chose FEDS because it seemed like the one that most other federal law enforcement personnel I ran into were already using. It was and still is recommended by the Federal Law Enforcement Officers Association (FLEOA), so it seemed like a safe and easy choice. I was already familiar with FLEOA and had been a member so I simply decided to go with their recommendation. Also If you are a FLEOA member and choose to work with FLEOA counsel initially, FEDS will not deny your claim due to a delay of reporting. With that being said Starr Wright USA was the very first company to invent and offer federal employee liability insurance. Starr Wright USA has been around a long time, have many law enforcement clients, and are similarly well respected in the industry.

Prices & Coverage Comparison:

There are a few differences between the types of packages that FEDS and Wright offer and they are both eligible for up to 50% agency reimbursement. Both also offer LEOSA (Law Enforcement Officer Safety Act) coverage.

- The Wright policy ($2 Million Liability/LEOSA Coverage/$200K limit on Criminal & Admin legal fees) has a base cost of $345 annually, including LEOSA coverage. Wright also typically offers a 10% discount if you renew within a certain timeframe.

- The FEDS policy ($2 Million Liability/$200,000 limit on Admin Legal Fees/$100,000 limit on Criminal Legal Fees) has a base cost of $390 Annually. FEDS also offers a less expensive $1 million policy and a more expensive $3 million policy. FEDS will defend and indemnify up to the full $1, $2, or $3 million limit. LEOSA coverage is an additional $100 or $150 annually*.

*Agencies do not reimburse any LEOSA coverage costs. Also make sure that you read your policy to ensure the LEOSA coverage protects you in two ways:

- Fills the LEOSA civil exposure gaps similar to the on-duty civil liability gaps if the agency makes the determination that you were acting outside of agency LEOSA authority.

- And also if you were acting within your authority but found outside of scope, and/or outside the interest of the U.S. to defend in a LEOSA situation.

It is imperative that you truly understand scope and interest – how and when it applies, how and who makes these determinations, and how things have changed in the last few years. FEDS Protection will assign counsel PRIOR TO DOJ’s determination. If you are also a FLEOA member, you may use FLEOA legal counsel prior to invoking your FEDS benefits with no denial of reporting issues.

Note: Each agency has their own specific process but typically you submit a reimbursement form with the liability coverage receipt. Once processed, your 50% reimbursement (ie $167) is automatically deposited into your established payroll account

Ownership:

Another thing to consider is who owns these companies. FEDS is a US based and veteran owned liability insurance company. Wright has been around for years and started as a US based company but according to Newsweek was acquired by a Chinese company known as the Fosun Group in 2016 (Read Article). Most federal law enforcement personnel will understand why this might raise some legitimate security concerns. This review isn't meant to be an in-depth discussion regarding this point but I feel that it is worth noting, especially for special agents actively involved in the counterintelligence realm.

Endorsements:

As I already mentioned, FEDS is endorsed by FLEOA. They are also endorsed by the Senior Executives Association, Federal Managers Association, Professional Managers Association, and The Federal Wildland Fire Service Association.*

We at the Special Agents Blog here at

www.specialagents.org also highly endorse FEDS!

The Association of Customs and HSI Special Agents (ACHSIA), Association of Former Intelligence Officers (AFIO), Federal Employees Benefit Association (FEBA), National Black Coalition of Federal Aviation Employees (NBCFAE), US Marshals Service Association (USMSA), Association of Federal Narcotics Agents (AFNA), Association of National Park Rangers (ANPR).*

* There are other organizations not listed, that encourage their members to sign up for PLI and recommend both companies.

Both are obviously well respected companies that have worked to maintain their endorsements & reputation among this law enforcement community.

Customer Report - Wright Liability Insurance:

I recently interviewed a special agent who is an active customer with Star Wright USA. In 2014, his management received a complaint from a third party agency in regards to his attitude; which his supervisor then attempted to include in his annual performance report. This special agent seamlessly filed a claim with his liability insurance, was able to get an attorney assigned within 48 hours and used the legal services to prevent the inclusion of any negative comments in his personnel file. This special agent, who is aware of the possible counterintelligence issues, continues to use Star Wright USA due to his positive experience with the claims process.

These are just a few of the factors to consider and I think either one of these companies will be a good choice. Like I said before, initially I ended up going with FEDS primarily because it seemed like the common choice at the time among the people I knew and respected. Personally, I have chosen to stay with FEDS because I think the FLEOA endorsement is a fairly good indicator of quality and because I think the U.S. ownership of the company is an important factor (especially in this career field).

PRO TIP: As an active FLEOA member, you also get basic legal coverage in the event of on-duty incidents (Ideally, you would want FLEOA council assisting your private insurance attorney during a critical incident.). FLEOA representation should be seen as a *supplement* not a *substitute* for private insurance.

If you are interested in other options and would like to learn more before making a decision; you can check out this article which mentions another three companies that offer the same product. Top 5 Providers of Professional Liability Insurance for Federal Employees.

Comments

What are your thoughts about professional liability insurance? I encourage active 1811s to share their opinions with potential applicants. (Note: Guests can comment without a full account).