Here's to HSAs for a long life!

(Don't Worry, Explanation Below)

Health Savings Accounts (HSA)

The Short Version: Health Savings Accounts (HSA) are an often misunderstood complement to health insurance plans available to federal employees that can result in substantial savings for the savvy user. It is uniquely suitable for younger employees that have little to no medical expenses.

Why Most Federal Employees are Unaware of HSAs

The Special Agents Blog routinely receives questions about health insurance plans generally recommended for new Special Agents in the federal government (or any federal employee for that matter). The barrage of new hire information related to health insurance, W-9 Exemptions, Flexible Spending Accounts, Health Savings Accounts, life insurance, liability insurance, and others can be confusing, even if it isn’t your first job. Unfortunately, Human Resources will rarely offer any “helpful” advice, either because they don’t care, don’t know, or are too worried about liability.

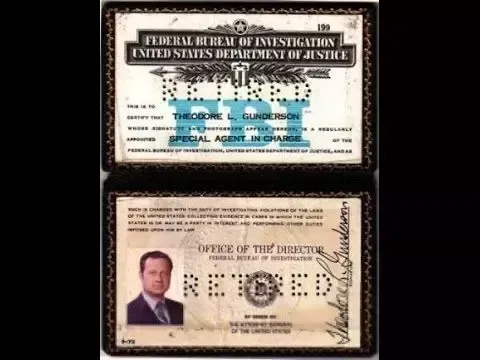

Important Disclaimer: I am not a financial advisor, but SA Blog would like to genuinely offer some information that my younger self would have appreciated knowing as a new federal employee in law enforcement regarding health insurance. Most importantly, the Special Agents Blog has no official affiliation with any health insurance plan, and this is in no way a paid advertisement or endorsement of any specific plan. This is just one older* special agent passing along some information to help out new agents.

General Health Plans for Federal Employees

Unlike what many people might think, federal employees do not have some special federal health insurance benefit that is free or significantly discounted compared to the rest of the public. Federal employees generally have access to the same smorgasbord of health insurance plans that other major private companies offer their workforce (i.e., Blue Cross, Aetna, United Health Care, etc.). Now, there are a limited number of specialty plans that are specifically for federal employees (i.e. GEHA), but that does not automatically make them better than something like Blue Cross. Just like in the private sector, you must make biweekly premium payments for your health insurance, and the associated payments are automatically deducted from your paychecks.

Many new young employees are often confused about which plan to chose and often end up selecting something like Blue Cross Blue Shield (BCBS) since it is easy. Such major insurance plans are well known, used by many employees, offer coverage for most medical needs, are widely accepted, and offer mental comfort in choosing the same thing that most co-workers use. As of this article, a SINGLE young new agent that selected BCBS pays somewhere between $95.74 and $150.79 every two weeks (each pay period) depending on whether the Basic or Standard Option (current 2024 rates) was selected.

Side Note: Oh, and welcome to the annoying health insurance lingo like “Basic” and “Standard” which normally would mean the same thing considering that basic is a synonym of standard.

Now don’t get me wrong, Blue Cross Blue Shield is a great plan for all the reasons I mentioned above. However, if you are young, not married, and just starting out in federal law enforcement, then you are probably physically fit and have relatively few health problems and medical visits (if any). For this young and fit category, it may seem that you are throwing away $207.44 - $326.71 every month when you will probably rarely go to the doctors for the first 5-10 years of your career (Note: Like most others, I did this for many years and threw away lots of money for services that were never used.).

The High Deductible Plan (HDP)

Another health insurance option is something called a High Deductible Plan (HDP). Generally speaking, this means that basic services like checkups are covered but more expensive procedures or treatments will be paid for out of pocket until you meet your “deductible” amount. After you pay enough money to meet the deductible amount, only then will your health insurance kick in to cover the rest. Additionally, this paid amount will reset every year. These plans are generally cheaper because of the high deductible.

If you are the type of person that regularly goes to the doctor for routine colds, minor issues or to get frequent antibiotics, then this might not be the plan for you. A run-of-the mill insurance plan is much more cost effective in the long run for the high frequency patient. Additionally, if you have a family member (i.e. spouse) with a chronic health condition, again a regular health plan is likely the better choice.

However, most new Special Agents are young and fit, and rarely require any routine health services during the beginning of their careers (remember, the young population traditionally subsidizes the cost of insurance for older and sicker people). So if you are indeed the type of person that doesn’t go to the doctor unless you have something major (i.e., a broken arm, or serious injury due to car accident), then a high deductible plan is potentially a great alternative option. Additionally, most federal employees are unaware that High Deductible Plans also come with something unique called a Health Savings Account (HSA), which offers some significant advantages and savings.

Health Savings Account (HSA)

A Health Savings Account or HSA is something you are not allowed to use unless you have selected a High Deductible Plan. This is basically a pre-tax retirement account that can only be used for health-related expenses. Additionally, similar to an actual Individual Retirement Account (IRA), there are government dictated limits on how much money employees can allot into these accounts every year because these types of accounts lower your taxable income. Being allowed to have an HSA is like having a second IRA but for medical expenses instead of retirement. Most importantly, the money in an HSA stays with you even if you switch back to a regular plan down the road (You just won’t be able to contribute to it any further.). Another awesome thing about HSAs is that you can actually invest the money into the marketplace just like you can with an IRA. So for example, if you haven’t used your HSA in a long time and start to have extra money piling up in the account, you can invest a portion of it in different funds depending on your HSA provider. Typical these are investment funds that track things like the S&P 500 similar to what you probably use in your 401k or "TSP" for federal employees. All the money you earn from your investments will be tax free in your HSA account!

The entire point of an HSA account is to help you cover the high cost of your deductible whenever you do have a health-related expense that is not included in the basic portion of your high deductible plan. Just like with car insurance there are certain things where your deductible applies and certain things where it doesn’t. For example, with some car insurance you can get your cracked windshield repaired and they cover it completely and your deductible does not apply. However, if you get in an accident you will have to pay your $500 or $1,000 deductible up front and then insurance will cover the rest. Imagine if you had a tax-free savings account that allowed you to save money for that deductible expense whenever you needed it. That’s essentially what an HSA does for you.

How HSA's are Funded

Now you might be asking yourself where does the money in the HSA come from? This is the part of HSAs that most people don’t fully understand and miss out on the benefits. Obviously, you can elect to put your own money into your HSA up to the government max of $4,150 for singles per year (this is the 2024 limit). Generally, this should be the amount you would have otherwise spent on a regular insurance plan. For example, let's say that selecting a High Deductible Insurance Plan saves you $150 per month; then at a minimum, you should place this $150 into your HSA each month! This is the part that takes a bit of self discipline.

But wait! What if I told you that there was a High Deductible Health Insurance Plan that would take a portion of your bi-weekly insurance premiums that come out of your paycheck and also deposit that amount into your HSA for you every month! Remember before, when I stated that Blue Cross would cost you $207.44-$326.71 per month coming out of your paycheck for self-only coverage. As we all know, you never get that money back from a normal health insurance plan EVER; even if you never see the inside of a doctors office for 5 years straight. That money essentially keeps going down the drain. Now some might say that is what insurance is for but if there was a way to get some of that money back then why not take advantage of it?

High deductible plans are not only cheaper than PPO plans like Blue Cross but some of them will actually give you back some of your bi-weekly premium and put that money into your HSA. Reviewing health plan brochures during open season is a pain and not exciting. They also do not make it clear how this process works. To be even more confusing, not all high deductible plans give you back a portion of your premiums, and the amounts vary. When I first found this out, I thought it was too good to be true until that first month’s deposit was made into my HSA from my biweekly premium. Like anything in life, it just involves a bit of research.

When I initially researched high deductible plans, I found that the one that gave you the most money back into your HSA was a plan called the MHBP Consumer Option (HDHP, High Deductible Health Plan). MHBP stands for Mail Handlers Benefit Plan. Since you are a highly trained criminal investigator you can probably tell from the name that this was originally for mail handlers, however it is now available to all federal employees. By the way, part of choosing this plan means that you also must sign up for the MHBP association which currently costs $52 a year. (They will send you a reminder after you elect your health plan). Currently if you sign up for the MHBP Consumer Option for self only the 2024 bi-weekly premium is only $78.69 or $170.50 per month. Remember that high deductible plans are cheaper because you have to pay for that deductible before full coverage kicks in. However, for a self only plan, MHBP will take $100 from that $170.50 and give it back to you in your HSA. That means you are really only paying $70.50 per month for health coverage and at the end of one year you will have $1,200 saved in your HSA. This will go a long way towards paying the $2,000 deductible for the MHBP self only plan.

If I had signed up for this plan when first hired, I would have likely had thousands of dollars saved by the time I was ready to get married and start having kids. If I had done this and ALSO contributed an extra $100 per month and invested that money into the market with my HSA, I would have even more available today.

Remember you always have the choice to switch back to a traditional plan during open season (or other qualifying life event) if you find that your health needs change and it no longer makes sense for you to be on a High Deductible Plan. When compared to the common choice of Blue Cross, MHBP will save you more than %50 per month and provide you with a second pre-tax vehicle to build long term wealth. In general, this is very valuable for younger employees that don't make as much during the beginning of their careers.

Other HSA Benefits

An HSA isn't simply to pay deductibles and can additionally be used to cover many routine medical expenses. Medical related products such eye drops and cold medicine are authorized expenses for the HSA (The HSA Account typically comes with a credit card that can be used for such expenses.). Most HSA providers provide a comprehensive list but they should all be relatively similar. You can reference an example list here. Additionally, many online platforms now mark certain items as "HSA eligible" to help make selections but you should always double check to make sure.

The most important thing to remember when you switch to an HSA eligible health plan is that it takes time for that money to build up in your respective HSA account. If you foresee additional medical services that would apply to your deductible, then it might not be a good time to switch. Additionally, when you first sign up it would be a good idea to fund the account with some of your own money up front to get things started. Additionally, you should also regularly contribute additional money on top of the amount that is refunded by the insurance company from the bi-weekly premium. Ideally this routine amount should be the savings you are making by switching to this High Deductible Plan (i.e. $100).

For all the above reasons, this is exactly why the High Deductible Plan and associated Health Savings Account is a good plan for young single agents who are in great physical shape. However, it does take fiscal discipline and a little bit of planning to ensure success.

HSA Setup Example

Getting things started with a high deductible plan can be a little confusing at first. For something like the MHBP Plan, it would typically involve the following steps:

- Pick your plan and sign up as directed by your federal HR department. It will vary slightly depending on what system is in use.

- You will receive information from MHBP regarding how to sign up for your HSA. As an example MHBP uses payflex for their HSA servicing.

- Go back to your HR department system and set up additional HSA allotments if you would like to contribute more than the money that MHBP puts in there automatically.

- Just like a checking or savings account there will be an account and routing number associated with your HSA to establish this allotment.

- MHBP will send you an initial and follow on annual reminder to send in your $52 annual membership fee.

- Your HSA account will send you a debit card that you can use to pay for things at the doctors or for HSA eligible expenses at the pharmacy or even on Amazon! Instead of using the card you can also submit a receipt and get refunded from your HSA. Your HSA will also sync with your insurance online and show you all your insurance related bills that are eligible for reimbursement (Note: They will still show up even if you already paid for them using your HSA debit card so don’t be surprised by this common quirk.). I usually just keep a mental note of which expenses I have already paid for but there is a feature to track expenses and mark expenses as paid.

- MHBP is serviced through Aetna so don’t be surprised when you have to login via the Aetna portal or when Doctors offices act like you have Aetna. MHBP is not super common so it's often easier to just say you have Aetna when you go in for visits.

Conclusion

This definitely might not be the best health plan for everyone’s situation but it’s something that I personally wish that I had learned about much earlier in my career. Plans like the MHBP HDHP are often overlooked because they are not as well known and can be slightly more confusing than your average health plan (which is likely already confusing enough as it is). Take charge of your finances early in life and educate yourself as much as possible about all the different options available for federal employees. It’s easy to ignore these types of things in your 20’s when retirement seems so far away but if you start planning now, your future self will thank you. Additionally, the more you get into it, the more fun it can be and when you maximize your finances with a bit of planning, you will save yourself quite a bit of stress down the road.

Stay safe and healthy out there!

References: