This website is an independent educational resource and NOT affiliated with any official U.S. government agency.

About IRS CI

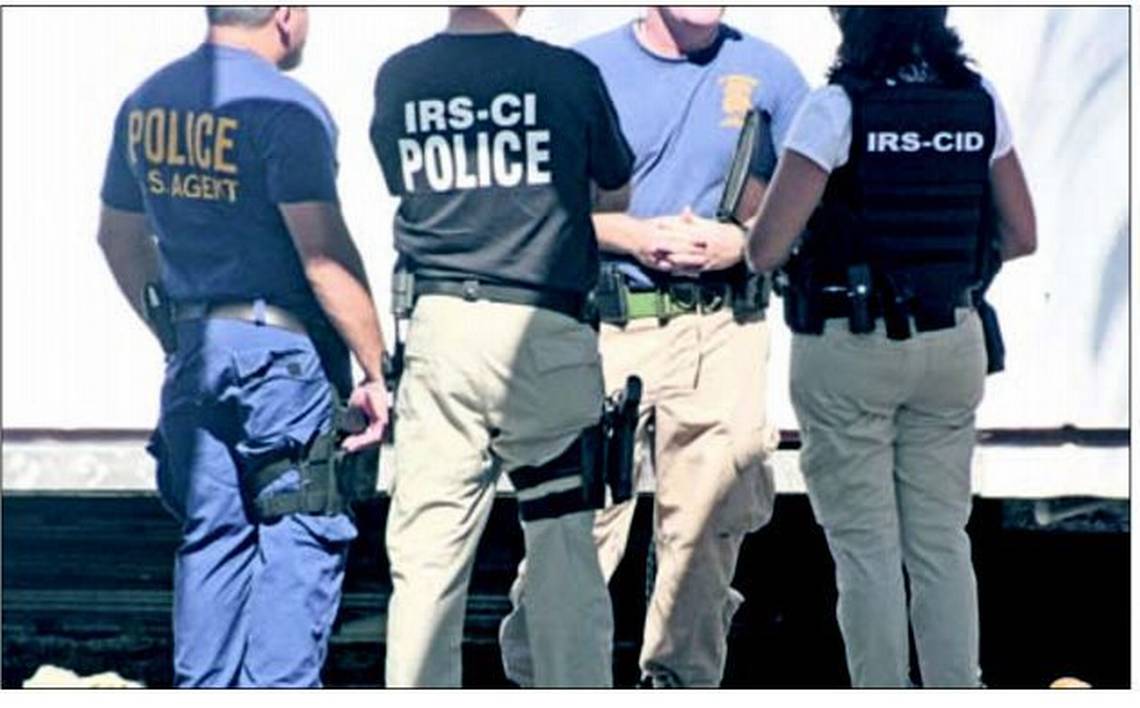

Internal Revenue Service (IRS) Criminal Investigation (CI) is a law enforcement agency located within the IRS and consists of approximately 2,000 Special Agents. The primary mission of CI is to protect the integrity of the tax collection system. IRS CI typically conducts investigations involving tax fraud, tax schemes, bankruptcy fraud, corporate fraud, employment tax enforcement, financial institution fraud, gaming, healthcare fraud, identity theft schemes, money laundering, and public corruption.

CI operates 21 field offices throughout the United States & 10 international posts of duty. Read the Annual Reports to learn more about the specific functions of CI.

IRS CI Overview

IRS CI is a premier financial oriented law enforcement agency with a very specific mission. CI Special Agents have unique authority to obtain tax related data, which gives them unchallenged access to critical financial information in support of criminal investigations. IRS CI is also responsible for a full time IRS Commissioner's Protective Detail.

Straight Talk CI

- Physical: You must pass a medical examination prior to being appointed. This position requires moderate to arduous physical exertion involving walking and standing, use of firearms, and exposure to inclement weather. Manual dexterity with free motion of fingers, wrists, elbows, shoulders, hips and knee joints is required. Arms, hands, legs, and feet must function sufficiently in order for applicants to perform the duties satisfactorily. Physical includes minimum Vision & Hearing standards.

- Other Medical Requirements: You must possess emotional and mental stability. Any condition that would hinder full, efficient performance of the duties of this position or that would cause an individual to be a hazard to himself/herself or to others is disqualifying.

- Be a U.S. Citizen

- Be younger than 37 at the time of receipt of a conditional offer of employment to continue in the application process. Applicants with veterans’ preference must be at least 21 years of age and younger than 40 at the time of receipt of a conditional offer of employment to continue in the application process.

- Possess a current valid driver’s license

- Qualify for the GL-07 level or the GL-09 level

- Qualify for a Top Secret clearance and undergo a complete background investigation, to include in-depth interviews, drug screening and medical examinations

- Certify that you have registered with the Selective Service System or are exempt from having to do so, if you are a male applicant born after December 31, 1959.

IRS CI Hiring Process

Online Application & Qualifications Review

Online Assessment

SA Knowledge & Skill Exam & Writing Sample

Interview

Conditional Job Offer

Background Investigation

Pre-Employment Tax Audit

Hiring Panel

Contact an IRS Special Agent Recruiter by visiting the IRS Criminal Investigation Special Agent page and scroll to the bottom for a link to the current recruiting POCs. Hiring announcements have also been posted on the official IRS Criminal Investigation Twitter feed.

IRS Criminal Investigation Academy Training

Special Agent trainees must initially complete the standard Criminal Investigator Training Program (CITP) at FLETC Georgia. After CITP is completed, candidates continue on to CI's 14-week specialized training (Special Agent Investigative Techniques Program), which includes instruction in tax law, criminal tax fraud, money laundering and a variety of financial fraud schemes. They are also introduced to agency-specific undercover operations, electronic surveillance techniques, forensic sciences, court procedures, interviewing techniques and trial preparation and testifying.

Training emphasizes the development of both technical and behavioral skills. It incorporates a highly interactive methodology of course delivery coupled with a high expectation of trainee interaction throughout the program. It is designed to provide new agents with the opportunity to progressively learn and practice more complex tasks required to perform on the job. This is accomplished through a combination of written examinations, graded practical exercises (PEs) and non-graded PEs designed to test the critical elements of the Special Agent position.

An outline of the entire IRS CI Training Program is available online: Read More

IRS CI Internship Program

The IRS CI maintains an unpaid student internship program and entry level career opportunities for students. Applicants need to contact their local office or use below link for additional information.

Special Agent Killed During Training

EOW - August 17, 2023

While conducting firearms training in Phoenix, AZ, Internal Revenue Service (IRS) Criminal Investigation (CI), Special Agent Patrick Bauer was shot and killed. The details of the incident are still pending an investigation by the FBI. SA Bauer was also a retired Master Sergeant in the Arizona National Guard.

Note: The circumstances surrounding SA Bauer's death have been kept confidential by federal authorities due to the related accidental discharge investigation involved in the incident.

Welcome to Video Takedown

Steaming from being left out in the cold by other federal agencies, two Internal Revenue Service (IRS) Criminal Investigation (CI) Special Agents decided to pursue a random lead from the United Kingdom. These IRS CI criminal investigators later teamed up with Homeland Security Investigations (HSI) and eventually coordinated a massive international crypto currency investigation to shut-down a darknet server hosting over 250,000 child sex abuse videos, and arranged for the arrest of its South Korean operator. A parallel investigation led to the arrest of 337 suspects and rescue of several underage victims. The investigation involved an "Octopus Man," multiple agencies, suicides and suspects with security clearances. To date, it is among the most successful child sex abuse and crypto investigations. Read More

Wired Magazine

ButtonOn July 19, 2023, IRS Criminal Investigation Supervisory Special Agent Greg Shapley and Special Agent Joe Zeigler provided required testimony in front of the House Oversight and Accountability Committee. Their joint testimony revealed that the Justice Department "slow-rolled" the Hunter Biden investigation. 1811 Criminal Investigators are career civil service government employees and do not work for any single political party.

CI Special Agent

IRS Criminal Investigation (CI) Special Agent Paulina Rodriguez is prominently profiled in this magazine article. All applicants are highly encouraged to read!

IRS CI - Quick Facts

● CI is the only federal law enforcement agency with jurisdiction over violations of the federal tax laws and shares

jurisdiction over money laundering and bank secrecy act (BSA) violations.

● CI is the 6th largest federal 1811 law enforcement agency with about 2,000 special agents and over 2,800 employees.

● CI special agents are sworn law enforcement agents, with law enforcement authority like their counterparts at

FBI, DEA, HSI, Secret Service and ATF.

● CI special agents are widely considered to be the best financial investigators in the U.S. Government and are often

brought into investigations by the U.S. Attorney for their financial skillset.

● CI has 21 Nationwide Field Offices and 10 International Posts of Duty.

● About 2/3 of CI’s time is spent working tax or tax-related investigative matters and about 1/3 is spent on non-tax.

Three of The First

Books authored by former IRS Criminal Investigations (CI) Special Agents appear to be few and far in between. Hilton Owens, Sr., one of the first African American special agents in the Internal Revenue Service, offers a unique glimpse into the intriguing world of undercover IRS operations.

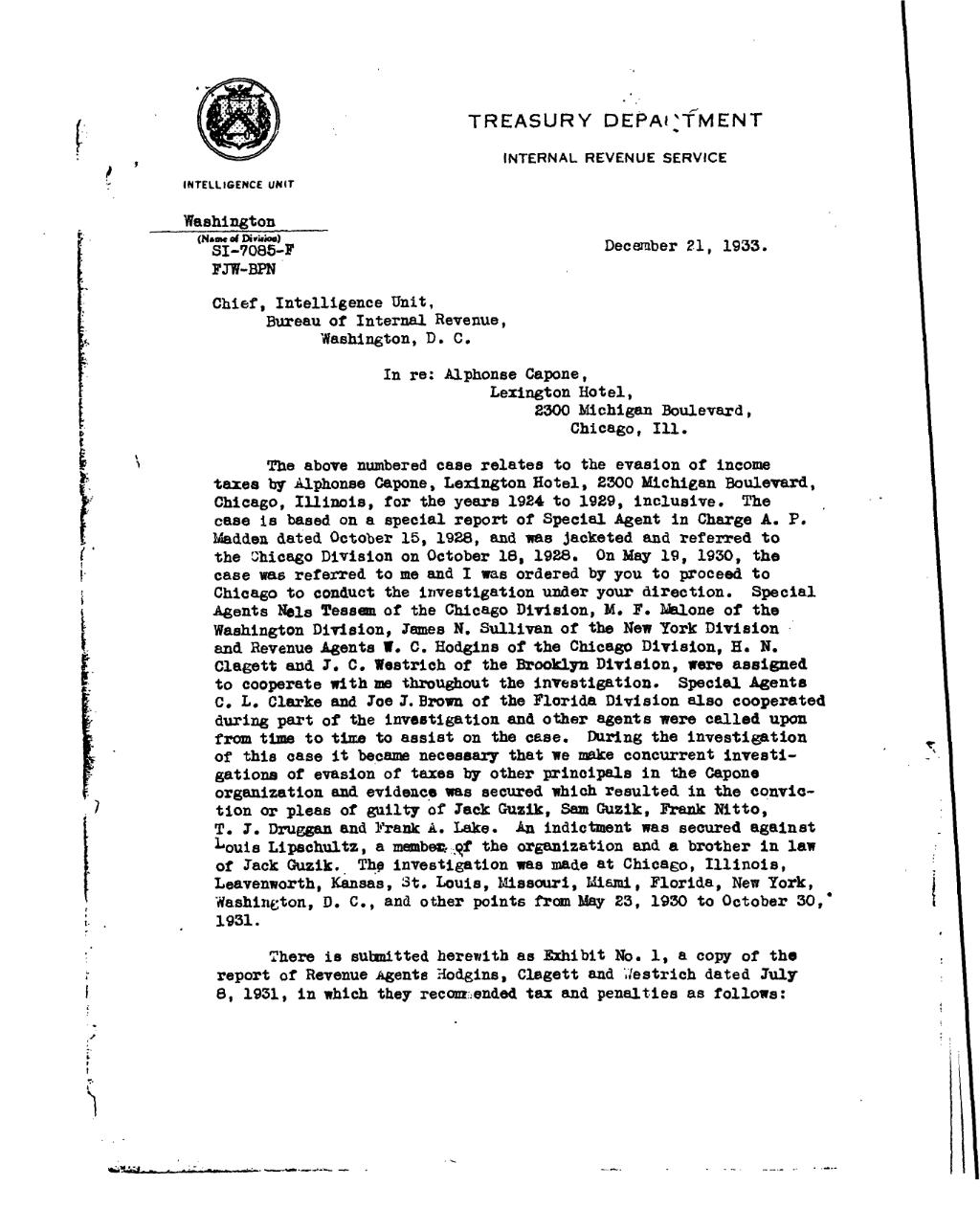

The origins of IRS CI date back to an Intelligence Unit created under the Bureau of Internal Revenue. Read this 2019 Annual Report to learn more about the history and mission of IRS CI.

Former Chief, Criminal Investigation

Don Fort was the former Chief of IRS Criminal Investigation from 2017 to 2020. A recent podcast interview by the Federal News Network provides great insight into this agency & recommended for applicants.

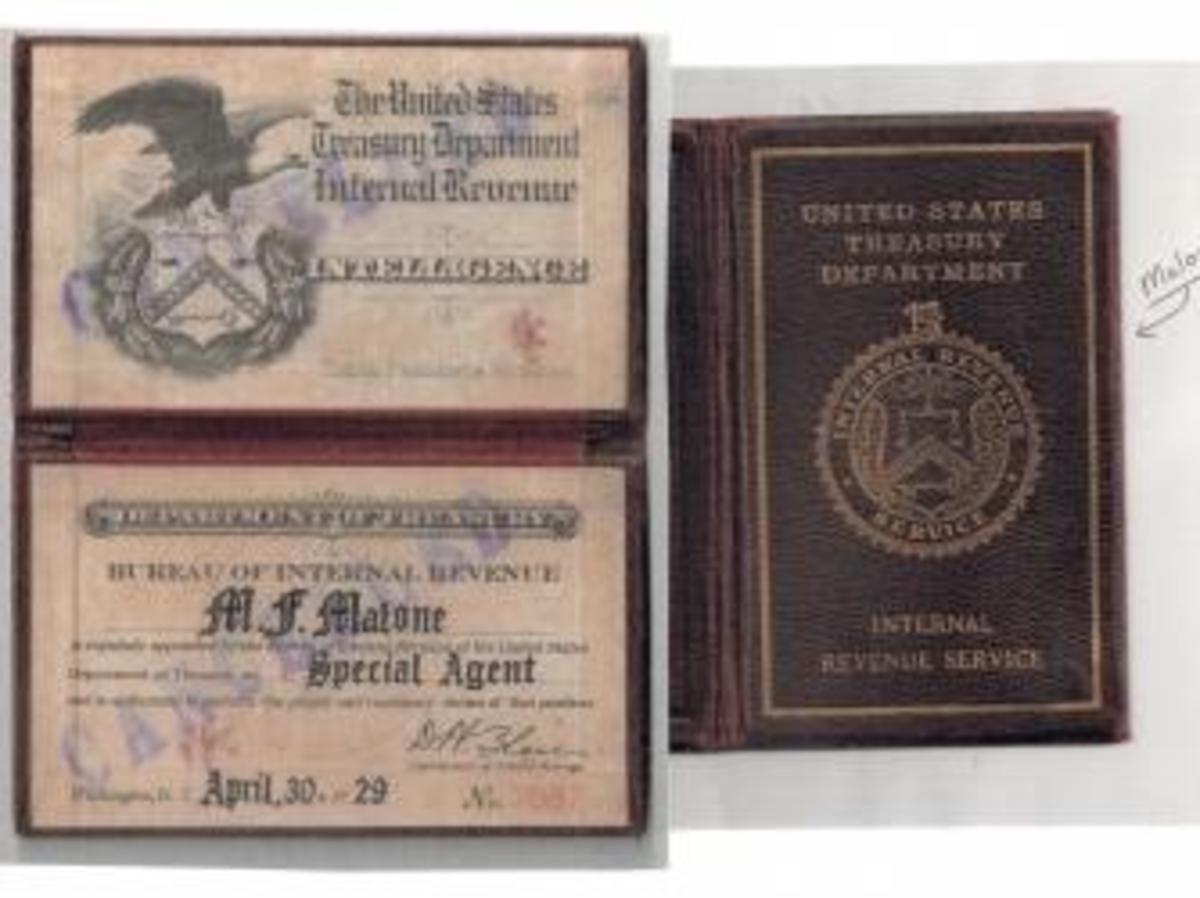

Provided by Association of Former Special Agents-IRS

Upon creation of the unit to investigate widespread allegations of tax fraud, United States Post Office Inspectors were transferred into IRS for purposes of carrying on this function in what became the “Special Intelligence Unit.” The position was eventually changed to IRS Special Agent. Read More

Special Agent in Charge

IRS CI SAIC Nevarez

CI Special Agent in Charge Ismael Nevarez went from a student to a senior leader within IRS Criminal Investigation.

IRS YouTube

CI Seeks To Leave IRS

The Special Agents of IRS Criminal Investigation have teamed up with FLEOA to officially request a realignment due to issues concerning funding & organizational structure. This would involve a complete removal from IRS and transfer to a new Bureau of Criminal Investigation within the Dept. of Treasury.

FLEOA sponsored House Resolution 5296 in support of this transfer. However, the resolution was ultimately unsuccessful.

Badge Collector

Retirement Gig

Some retired guys fish, others play golf; a subset of humans also like to write down tail numbers of landing aircraft. Whatever floats your boat. This particular retired IRS CID Special Agent collects badges. Good for him.