This website is an independent educational resource and NOT affiliated with any official U.S. government agency.

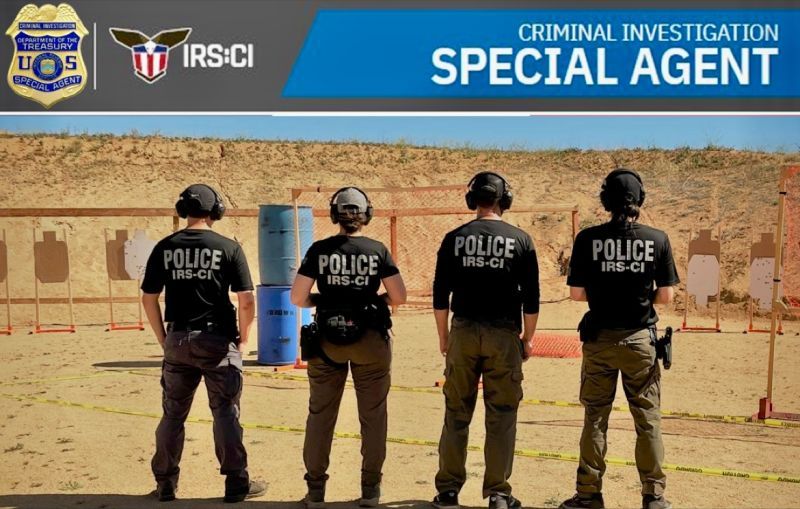

So you want to be an IRS Special Agent?

Internal Revenue Service (IRS) - Criminal Investigation (CI)

Criminal Investigation (CI) is a federal law enforcement agency created within the IRS in 1919 and is primarily composed of approximately 2,000+ Criminal Investigators. The Special Agents of the Internal Revenue Service (IRS) - Criminal Investigation (CI) are a small and elite cadre of series 1811 Criminal Investigators that have specialized skills pertaining to financial investigations. CI Special Agents primarily focus on tax evasion type crimes, however, they also have a prominent role in tackling money laundering, fraud schemes and supporting other federal investigations with their unique financial analysis resources.

Addressing Inaccurate Media Portrayal

Over the past few years, a number of media outlets have purposefully and confusingly mixed the role of "IRS Auditor" with "IRS Special Agent." Some of these sensational articles have inaccurately claimed or insinuated that the IRS is trying to arm their audit personnel. Although both positions are often referred to as "IRS Agents" in common parlance, there are night and day differences between the two job series. Below is a quick explanation of the critical distinctions:

- IRS Auditors (Series 0512): This is an administrative civil service position located within the IRS. These auditors typically review tax returns and look for indications of tax evasion during formal audits. Auditors will often impose civil penalties on tax scofflaws and monitor compliance on an ongoing basis. IRS Auditors are not law enforcement officers and have no ability to make arrests or conducts searches. The majority of IRS personnel are these civilian Auditors and they will never have the authority to carry firearms.

- IRS Special Agents (Series 1811): This is a federal law enforcement position located within IRS Criminal Investigation (CI). IRS Special Agents focus on "criminal investigations," for that reason they must all be law enforcement officers by law and carry firearms. IRS Special Agents must complete the Criminal Investigator Training Program (CITP) and the follow-on IRS Investigative Techniques Program. The IRS Criminal Investigation Special Agent position is the same as that found within the DEA, FBI, ATF, and HSI.

All prospective candidates must critically understand the difference between these above two positions and not be mislead by inaccurate media reporting.

Reality of IRS CI

Criminal Investigation is hyper-focused and spends 100% of its investigative efforts on financial related investigations. In FY 2022, IRS CI proudly identified more than $31 billion in tax fraud and financial crimes, in addition to seizing $7.1 billion in assets from criminals. Their specialized focus comes with a commendable conviction rate of 90%.

The typical IRS Case Categories include the following:

- Tax Crimes: General Tax Fraud, Refund Fraud, Employment Tax Fraud (Largest Case Category)

- Non-Tax Financial Crimes: Money Laundering, Public Corruption, Corporate Fraud, General Fraud

- Other: Cyber Crimes, Narcotics, National Security

Note: The overwhelming

majority of non-tax related investigations (i.e., narcotics, corruption) are typically conducted in close coordination with partner agencies (i.e.

FBI,

HSI,

DEA).

In addition to the above criminal investigations, IRS CI maintains a full time Protective Service Detail for the IRS Commissioner. IRS CI additionally has a small cadre of overseas Special Agents filling Attache positions in 11 different countries.

Like comparable 1811 Agencies, IRS CI also provides its Special Agents with a Take Home Vehicle, opportunities to travel, advancement to the GS-13 pay grade and advanced training regarding financial investigative techniques.

It should be noted that in 2015, Criminal Investigations personnel worked with the Federal Law Enforcement Officers Association (FLEOA) to request a permanent transfer of Criminal Investigation out of IRS and under the direct umbrella of the Department of Treasury as an independent agency. This effort was ultimately unsuccessful but reveals the deep seated problems that the investigative workforce of CI is routinely having with IRS oversight (which is non-law enforcement trained or oriented).

The above referenced investigative portfolio readily demonstrates that IRS CI Special Agents should primarily expect a career in detail oriented and painstaking financial investigations. Although obtaining minimal tactical proficiency is a requirement to graduate form the academy, applicants should know that IRS Special Agents rarely engage in high risk tactical operations as they are typically unnecessary to support the primary financial investigative mission.

To learn more, I encourage prospective applicants to read the IRS Criminal Investigation Annual Reports.

Getting Hired by IRS CI

Starting in 2023, CI has started to post extended entry level Special Agent vacancy announcements on USA Jobs that accepts applications for the majority of the year. It must be noted that CI has a very specific financial education requirement, which is necessary to pass the follow-on Special Agent Investigative Techniques Program.

Applicants that do not have prior experience as Criminal Investigators or specialized work experience in Accounting or Auditing must typically have the following education in order to be minimally qualified:

- One full year of graduate level education which included or was supplemented by at least 15 semester/23 quarter hours in accounting plus an additional 9 semester/14 quarter hours from among the following fields: business law, economics, finance, tax law or money and banking.

OR

- Superior Academic Achievement - A bachelor's degree, with one of the following: A GPA of 3.0 or higher on a 4.0 scale for all completed undergraduate courses or those completed in the last 2 years of study, or a GPA of 3.5 or higher on a 4.0 scale for all courses in the major field of study or those courses in the major completed in the last 2 years of study, or rank in the upper one third of the class in the college, university, or major subdivision, or membership in a national scholastic honor society recognized by the Association of College Honor Societies.

Prospective IRS Special Agent candidates typically* need a financial background or aptitude in order to successfully pass the full IRS Criminal Investigator Training Program.

In Conclusion

Although Criminal Investigation is a relatively unknown investigative agency and often confused with "Big IRS," CI is an excellent place to embark on a career in federal law enforcement, especially for those applicants that possess the requisite financial aptitude, skills and education. The financial specialization offered by IRS CI often makes it a very desirable federal partner for large scale investigations and investigators can routinely expect joint cases with other agencies.

Review my detailed IRS Criminal Investigation Profile Page to learn more!